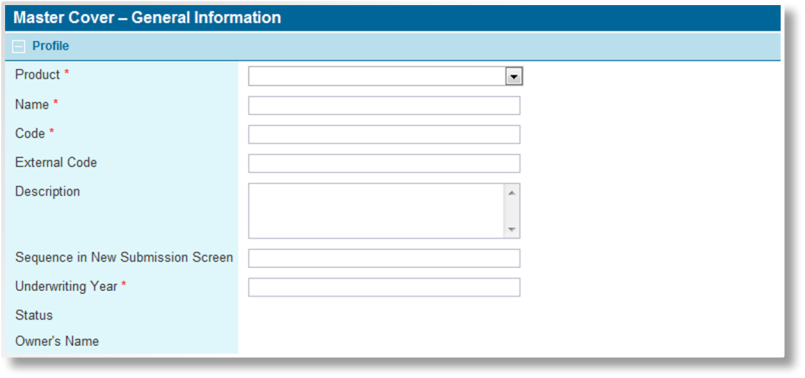

General Information

The General Information page contains general settings for submissions and policies, as well as for the master cover itself. The controls for setting the master cover to Draft, Test, or Live, copying the master cover, or generating a master cover report are also included here. This page is presented when creating a new master cover, and is the first page shown when opening an existing master cover.

For instructions on finding and viewing a master cover, see the section on Viewing and Modifying a Master Cover.

|

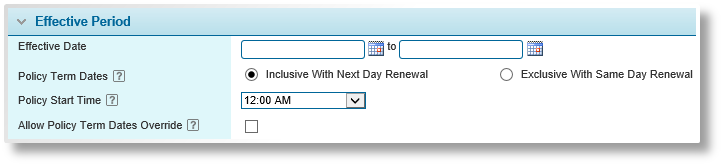

Enter the effective period of the master cover, or select the dates from the calendar lookups |

|

|

Policy Term Dates |

This setting controls when a Policy Renewal will occur in relation to the prior term’s Valid Until date. |

|

See Setting Effective Period and Time of Day for Policy Terms for detailed examples of the use of this feature. |

|

|

The effective period includes the entire Valid Until date, with any renewal starting on the day after the Valid Until date. |

|

The Policy Start Time setting will be set to 12:00 AM, but will have no effect on the effective period of the term. However, the time component will be visible when the term dates are used in documents or calculated fields, so formatting or formulas may need to be adjusted. With this setting, the system uses all days in the term for rating calculations. |

|

|

The effective period includes part of the Valid Until date, up to the selected Policy Start Time. Any renewal will start from the Policy Start Time of the previous term’s Valid Until date. |

|

With this setting, the system uses the entire first day of the term for rating calculations, but excludes the last day. This ensures that the calculations are performed with the correct number of days for the term, regardless of mixed settings. |

|

|

Note: Any master cover settings that restrict the dates of the Effective Period can conflict with the option chosen for the Policy Term Dates field. Make sure that all date restrictions are known before configuring these options. |

|

|

By default, the time for the Effective Date and Valid Until date fields (the "effective period") in a submission or policy is set to midnight (12:00 AM, not shown in the submission/policy form). When the Exclusive With Same Day Renewal option is selected, the effective period can be set to begin and end at a specific time of day (to the hour). When the Inclusive With Next Day Renewal option is selected, the Policy Start Time is always set to midnight. |

|

|

When set to 12:00 AM, the effective period includes the full first day, and may or may not include the full last day of the period, depending on the selection in the Policy Term Dates field. |

|

|

When set to any other time, the effective period is from the selected time of the first day, to the selected time of the last day. |

|

|

This feature requires the Exclusive With Same Day Renewal option above to be selected. Otherwise the time is defaulted to 12:00 AM and cannot be changed. |

|

|

See Setting Effective Period and Time of Day for Policy Terms for more information on configuring this feature. |

|

|

Allow Policy Term Dates Override

|

By default, New Business terms will use the Policy Term Dates settings from the master cover, while all renewal terms will inherit the settings from the previous term. |

|

When this option is checked, the selection made for the Policy Term Dates field can be changed for each term. The Policy Term Dates field is available in the Policy Information detail window, with the same options as in the master cover. Changing the settings for a term affects how the end of the term and any renewal will be handled. |

|

|

When this option is unchecked, the master cover settings will apply for all terms, and cannot be changed. |

|

|

Note: When creating a copy of a transaction:

|

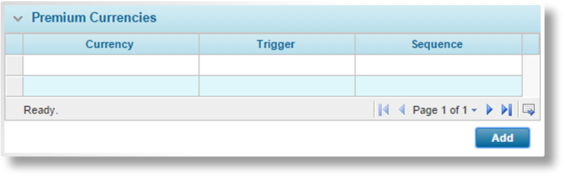

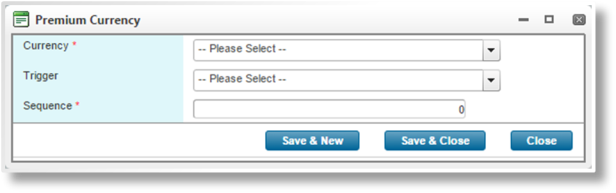

The Premium Currencies panel is used to define which currencies are available for policies under this master cover. Whenever the system calculates quotes for a New Business or Renewal transaction, the available currencies will be evaluated according to sequence and trigger. The first currency whose trigger evaluates to true will be used for all premiums in the current policy term and any additional transactions within the term.

Note: The currency is applied to the calculated premium values without any conversion. For example, a calculated premium of 100 would show as 100 USD, 100 EUR, or 100 CAD, depending on which currency is assigned.

- To add a currency, click Add. To view an existing currency, click a link in the Currency column. The Premium Currency window opens.

- Fill in the necessary information. Fields marked with a red asterisk * are required.

- Click Save & New to save the currency and clear the form to add a new currency, click Save & Close to save the currency and close the window, or click Close to close the window without saving the currency.

|

Select a currency to add. |

|

|

Select a trigger to control if the currency should be applied. Enter at least three characters to search for triggers. |

|

|

|

If all triggers fail, an error will occur. The currency with the highest Sequence number can be set without a trigger as a default value, in case no other currencies are valid. |

|

Enter a sequence number. The system will evaluate each currency in increasing sequence, and the first currency whose trigger evaluates to true will be assigned to the transaction. |

|

|

Tip: It is advisable to leave gaps between the sequence numbers, such as 5, 10, 15. This allows new items to be added to the list at a later date, inserted between existing items. Otherwise, the sequence numbers of existing items must be changed to allow for the new addition. |

When viewing an existing currency, click Delete to delete the currency.

|

Select the workflow to be used for this master cover. The workflow defines the layout of the entire submission process. |

Tip: Changing a workflow after attaching items linked to the existing workflow could cause those linked items to stop functioning. After changing a workflow, check the rest of the master cover settings to ensure that all features are complete.

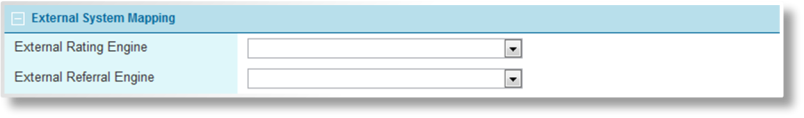

The Bridge Specialty Suite supports integration with some external systems. The master cover can be mapped to those systems in this panel.

|

An external rating engine can be selected. |

|

|

An external referral engine can be selected. |

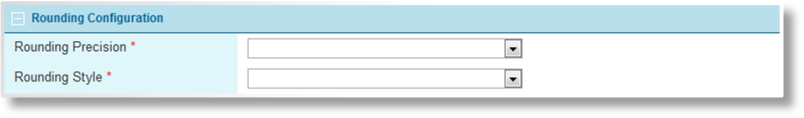

Premiums, commissions, and other calculated values are generally rounded off when displayed on the screen. The Rounding Configuration panel is used to set how rounding is performed.

|

Select what digit the numbers should be rounded off to. |

|

|

To be rounded to the cent. |

|

To be rounded to the next 10 cents. |

|

To be rounded to the next dollar. |

|

To be rounded to the next ten dollars. |

|

To be rounded to the next hundred dollars. |

|

To be rounded to the next thousand dollars. |

|

Select how the rounding is performed. |

|

|

The value 23.5 gets rounded to 24, but −23.5 gets rounded to −23. |

|

|

The value 23.5 gets rounded to 24, and −23.5 gets rounded to −24. |

|

|

The value 23.5 gets rounded to 24, 22.5 gets rounded to 22, −22.5 gets rounded to −22, and −23.5 gets rounded to −24. |

|

|

The value 2.1 gets rounded to 3, and -2.9 gets rounded to -2. |

|

|

Caution: In cases where a rate driver changes for one endorsement, but does not change in subsequent endorsements, the rounding may result in an endorsement premium equal to the selected Rounding Precision. |

|

|

The value 2.9 gets rounded to 2, and -2.1 gets rounded to -3. |

|

|

Caution: In cases where a rate driver changes for one endorsement, but does not change in subsequent endorsements, the rounding may result in an endorsement premium equal to the selected Rounding Precision. |

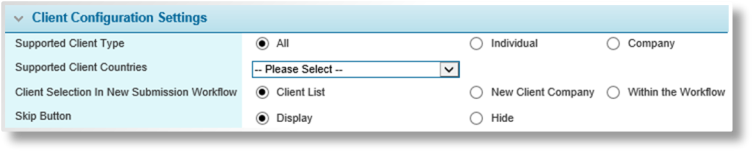

When a user creates a submission, they can select a client, create a client, or skip this step altogether. The Client Configuration Settings panel controls these options, defining what clients can be selected or created, and which client screens will appear to the user before they start the submission.

|

Clients can be companies or individuals, depending on the nature of the product. Select Individual or Company to only permit that type of client, or select All to allow either type. |

|

|

If the product is only meant to be available for certain regions, a list of countries can be selected. Only clients from the listed countries can be selected, or when creating a new client, only the listed countries are available. |

|

|

There are multiple ways to provide client information for a new submission. Select one of the following options. |

|

|

After the distributor is selected, either automatically or manually, the user will be presented with the Select or Create Client list. The user can select an existing client or create a new client. |

|

|

This option is visible when All or Company is selected for Supported Client Type. After the distributor is selected, either automatically or manually, the user will be presented with the New Client Company page, where a new client company can be immediately created and attached to the submission. The user can still navigate to the Select or Create Client list, allowing them to select an existing client or create an Individual Client. |

|

|

After the distributor is selected, either automatically or manually, the user will be brought to the first page of the submission. They will be required to enter the client information on a custom screen in the workflow. |

|

|

The fields, panels, and screens designed to collect client information on a custom screen are described |

|

|

This field is visible when Client List or New Client Company is selected for Client Selection in New Submission Workflow. When creating a new submission, the user is prompted to select or create a client. This setting determines if the Skip button will be available to allow the user to skip this step. |

|

|

The Skip button will be visible. Users can click on it to begin the submission without selecting or creating a client. A client will still need to be selected or created before the submission can be bound. |

|

|

The Skip button will be hidden. Users will be required to select or create a client before beginning the submission. |

The Commission Settings panel can be used to define a default commission percentage from a field in the workflow. See the Distributor Commission Fallback Order section for details on when this value is used.

| Commission Percentage Field | Select a field from the workflow. Only Textbox (Decimal) fields configured as Rate Drivers are available for selection. |

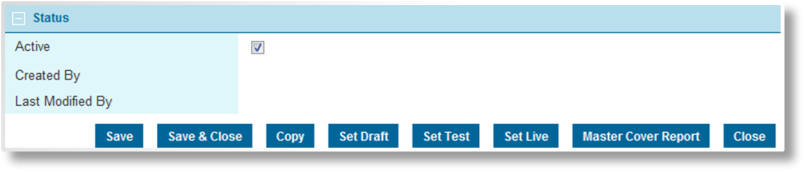

The Status panel is available once the master cover has been saved.

|

Marks the master cover as active and available for use. If unchecked, the master cover remains linked to any existing submissions, policies, and resources, but cannot be used for new submissions. |

|

|

Identifies the date and time the master cover was created, and the user who created it. |

|

|

Identifies the last date and time the master cover was changed, and the user who made the changes. |

Click Save to save the master cover but remain on the page, click Save & Close to save the master cover and return to the master cover list, or click Close to return to the master cover list without saving the master cover.

Click Copy to make a copy of the master cover. See the section on Copying a Master Cover for details and notes about copying.

Click Set Draft, Set Test, or Set Live to control the status of the master cover. See the section on Setting Master Cover Status for details.

Click Master Cover Report to generate a report containing details of the master cover and settings. See the section on Generating a Master Cover Report for details.

. When a start date is entered or selected, the end date is automatically defaulted to one year later (minus one day), but can be changed.

. When a start date is entered or selected, the end date is automatically defaulted to one year later (minus one day), but can be changed.